The 3-Minute Rule for Bad Credit Financing

Table of ContentsThe Only Guide to Bad Credit FinancingSome Known Details About Bad Credit Financing 10 Simple Techniques For Bad Credit FinancingBad Credit Financing for BeginnersUnknown Facts About Bad Credit FinancingBad Credit Financing Fundamentals ExplainedThe Main Principles Of Bad Credit Financing

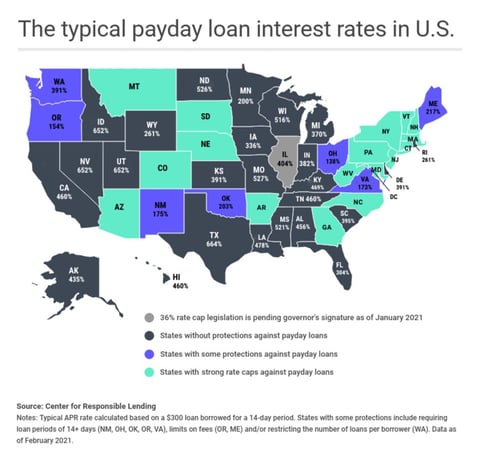

Consumers with inadequate credit scores might qualify for reduced rates of interest given that they're putting up collateral. If you back-pedal a safeguarded lending, your lender might legally confiscate your security to recoup the cash. And if your loan provider does not redeem the expense of the finance by retrieving your properties, you might be accountable for the difference.This method can make it simpler for consumers with negative debt to be eligible for a funding, as it reduces the main consumer's threat. These loans are commonly much less than $500 and also are anticipated to be paid back within two to four weeks. Many individuals that take out payday finances often have to take out extra fundings to pay off the initial payday lending, capturing them in a cycle of financial obligation.

The Only Guide to Bad Credit Financing

Customers that have excellent histories with their bank. If you require a temporary fix, you can use a currently desirable relationship for monetary aid. This option may not be used in all financial institutions. If you have bad credit scores, you may be able to cash in on the equity you've developed right into your residence making use of a home equity finance.

Like individual financings, with a house equity loan, you'll be given the cash in a swelling amount. Those that require big sums of money as well as have equity in their home Allows borrowers to take out up to 80% of their house's value. Since you're using your home as collateral, defaulting on your residence equity lending may result in shedding your residence.

Unlike residence equity finances, HELOCs commonly have variable passion prices. Customers who aren't sure just how much cash they want and needs to be able to obtain from their home's equity over a period of time Customers can borrow and repay as needed, and recycle the line of debt. Given that rate of interest rates vary, debtors may experience highly monthly repayments.

The Single Strategy To Use For Bad Credit Financing

While many lenders do not permit customers to make use of a personal financing toward education and learning funding, loan providers like Startup do permit it. Those that are seeking financing for academic objectives Some student funding lending institutions will cover to the whole price of your tuition. Some lenders have stringent or obscure forbearance and deferment programs or none at all in situation you're unable to pay off the lending in the future.

Make up all personal income, including income, part-time pay, retired life, financial investments and also rental residential properties. You do not require to consist of alimony, kid assistance, or different upkeep income unless you desire it to have it taken into consideration as a basis for repaying a funding. Rise non-taxable revenue or advantages consisted of by 25%.

The deals for economic items you see on our system originated from firms that pay us. The cash we make aids us offer you accessibility to cost-free credit report as well as reports as well as assists us produce our other terrific devices and also instructional products. Compensation may factor right into just how and also where products appear on our platform (and also in what order).

How Bad Credit Financing can Save You Time, Stress, and Money.

That's why we offer features like your Authorization Odds and also cost savings price quotes. Of training course, the offers on our system don't stand for all financial items out there, yet our goal is to reveal you as several wonderful options as we can. That doesn't indicate you should quit. If you need the cash for a true emergency situation expense or various other use, you can discover lenders that offer individual car loans for negative credit.

They come with expenses, including source, late as well as inadequate funds charges that might boost the amount you have to settle.

The Best Guide To Bad Credit Financing

Feasible offers the choice to obtain try this site up to $500 "instantaneously" and also repay your car loan in four installments. The loan provider claims it usually disburses funds within simply mins but that it might take up to 5 days. Feasible isn't available in all states, so check if it's provided where you live before you use.

The application does not bill interest when you pick the pay-in-four alternative, as well as there are no charges if you pay promptly. If your payment home is late, you may be charged a late charge of approximately 25% of the order worth. The amount you can spend with Afterpay varies based on numerous factors, including for how long you've been an Afterpay user, exactly how frequently you make use of the application, your app repayment background as well as even more.

Not known Facts About Bad Credit Financing

, finance a residence improvement or take treatment of an emergency expense, a personal finance may aid. Here are some points to know if you're thinking about applying for a personal financing with bad credit rating.

Below are a few basic terms to take notice of. APR is the total cost you pay yearly to borrow the cash, consisting of passion and specific costs. A reduced APR means the finance will generally cost you less. A personal financing for someone with bad debt will likely have a higher APR.

Many personal finances need you to make set monthly payments for a set amount of time. The longer the repayment period, the more interest you'll likely pay, and the more the finance is most likely to cost you. Month-to-month payments are navigate to this site mostly determined by the amount you borrow, your rate of interest and your funding term.

The Bbb has information regarding many loan providers, and you can inspect the customer complaint database maintained by the Consumer Financial Defense Bureau to figure out if individuals have filed issues against a loan provider you're taking into consideration. While getting approved for an individual lending can be tough and also expensive for somebody with negative credit report, loaning may make sense in particular scenarios.